Close

India isn’t just a consumer market anymore—it’s the operational nerve center of the global economy. With its projected GDP set to hit $5 trillion by 2027, a deep digital talent pool, and robust infrastructure, India is now the strategic destination for offshoring mission-critical functions. But let’s be clear: diving into India without a defined offshoring strategy is like deploying a product without QA—you may crash before you even launch.

Whether you’re setting up a tech delivery center, a financial back office, or a full-fledged GCC, this guide breaks down the most effective offshoring models.

So, how do you crack this market? What’s the best way in?

Let’s explore the most common routes foreign companies take when entering India, what works for whom, and what you should think about before making your move.

If your offshore scope involves stepping into a regulated sector or needs someone who knows the local ropes, joint ventures are a solid bet. Imagine teaming up with a local player who understands the culture, the government officials, and the market quirks. You share the risk, the resources, and ideally, the rewards.

Starbucks nailed this approach. They didn’t just set up a shop and hoped for the best. Instead, they partnered with Tata Global Beverages back in 2012. Tata’s local muscle helped Starbucks expand steadily—over 300 outlets across 25+ cities by 2023. That kind of growth doesn’t happen by accident.

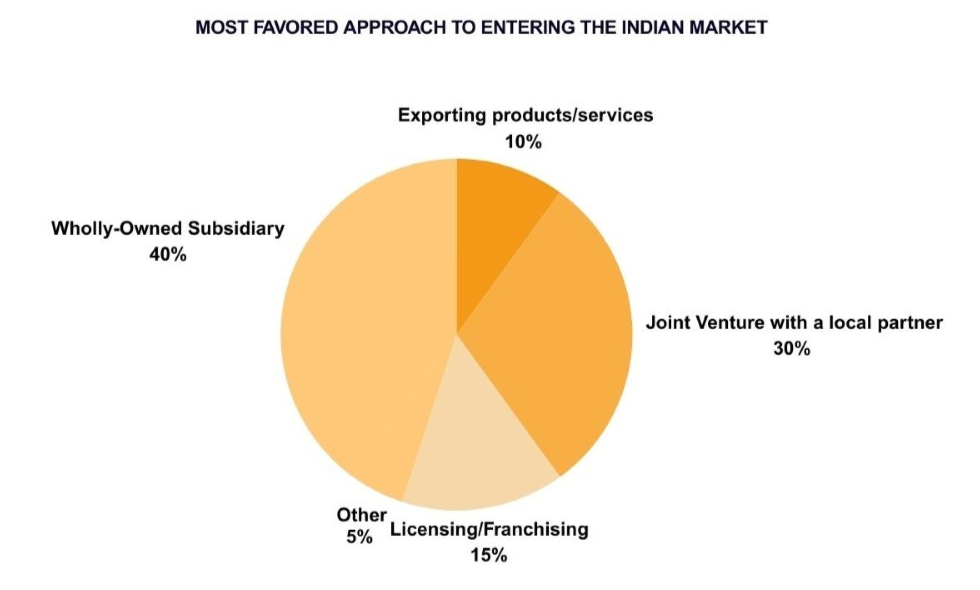

Of course, a JV isn’t a magic pill. It needs a strong chemistry between partners and aligned goals. According to a survey by SRKay Consulting, about 30% of businesses prefer joint ventures specifically because it helps tackle India’s complex regulatory environment while benefiting from local expertise.

Want total control? This is your route—but it’s not for the faint-hearted or those low on capital. Owning your Indian arm outright means you get to steer every decision, from branding to day-to-day operations.

Amazon chose this path. Since 2013, they’ve invested billions—over $6.5 billion—and carved out a massive slice of India’s e-commerce pie, claiming more than 30% market share. The upside is obvious: complete control means you can align everything with your global standards.

But keep in mind: navigating Indian laws solo is tough, and the investment is hefty. Still, 40% of business leaders in that SRKay survey say they prefer this approach because it fits their long-term vision.

Not ready to commit capital upfront? Want to test scalability before going all in? The BOT model is ideal. A local partner builds the delivery center, runs it for a few years, and once operations stabilize, you take over.

This hybrid model is fast becoming the preferred offshoring route for mid-size tech firms and large enterprises testing Indian waters.

It’s offshoring without the headache of day-one legal, infra, and HR setups—SRKay’s BOT-as-a-Service model has helped multiple companies transition from 0 to 500+ people within 12–18 months.

Many global players now take a hybrid route—they own the high-sensitivity functions via captives, while outsourcing support roles (like payroll, recruitment, facilities) to Indian vendors or partners.

It’s the best of both worlds: control where it matters, flexibility where it doesn’t.

Technology, industrial, and B2B companies often opt for strategic alliances—collaborations without ownership stakes. Cisco’s partnerships with Indian telecom companies, which helped them roll out infrastructure, is a classic example.

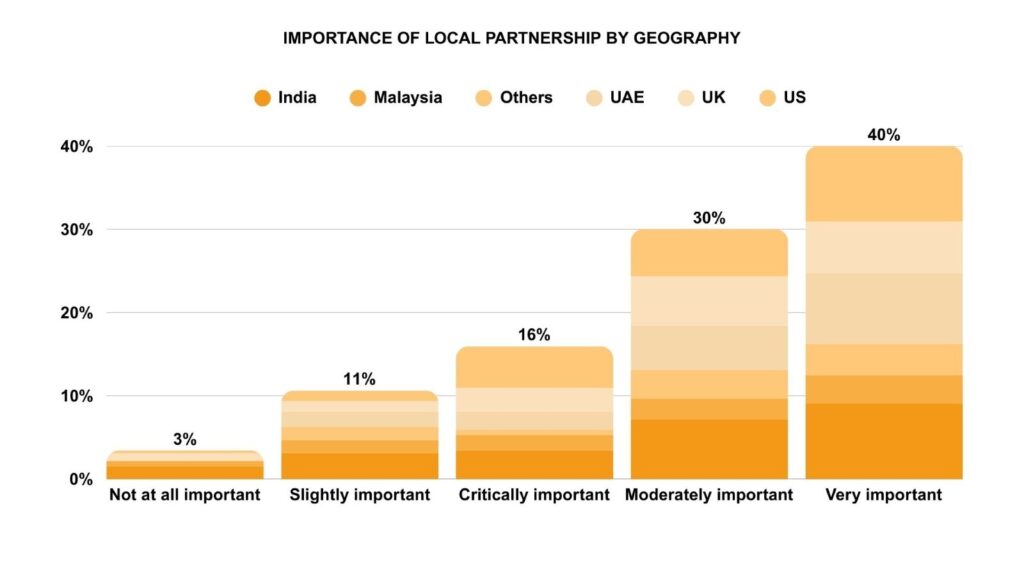

These alliances offer flexibility and allow companies to innovate together. SRKay’s research shows 40% respondents globally rate having a local partner as ‘Very Important’

When your business needs a customized setup—think manufacturing plants or specialized facilities—greenfield investment is the way. It takes time and money, but the payoff is full control.

Hyundai’s Tamil Nadu plant is a textbook example, making it India’s second-largest automaker. Sure, the initial costs are high, but the long-term benefits are worth it. Sure, the initial costs are high, but the long-term benefits are worth it. India offers capital subsidies of up to 25% in some states for such industrial investments.

If speed matters and you want an established footprint, acquiring a local company can fast-track your entry. It gives you access to customers, infrastructure, and local know-how.

But acquisitions are complex. You need to handle due diligence carefully and manage integration risks. Many global players prefer this route for quick scale.

If you want to test capabilities before setting up an entity, start by hiring Indian talent via an EOR (Employer of Record) or freelancing platforms. It’s a low-commitment way to explore productivity, cultural fit, and skills.

Once you’re confident, scale it into a formal operation.

| Model | Key Benefit | Investment Level | Best For | Example |

| Joint Venture | Local expertise + shared risk | Medium | Regulated sectors | Starbucks-Tata |

| Wholly Owned Subsidiary | Full control, brand alignment | High | Tech, BFSI, Long-term GCCs | Amazon |

| Build-Operate-Transfer | Low-risk scaling | Medium | Mid-sized, cost-sensitive firms | SRKay BOT programs |

| Captive + Partner | Optimize core vs. non-core | Medium | Large global firms | Retail + BPO hybrid |

| Greenfield Investment | Infrastructure control | High | Manufacturing, data centers | Hyundai (manufacturing) |

| Acquisition | Speed to market, talent access | High | Time-sensitive scaleups | Accenture India deals |

| Remote Offshoring/EOR | Talent testing, quick start | Low | Startups, exploratory teams | Freelance/EOR hiring |

Ask yourself:

SRKay’s I.N.D.I.A.S. Playbook helps organizations design the right fit, avoid missteps, and accelerate value realization in India.

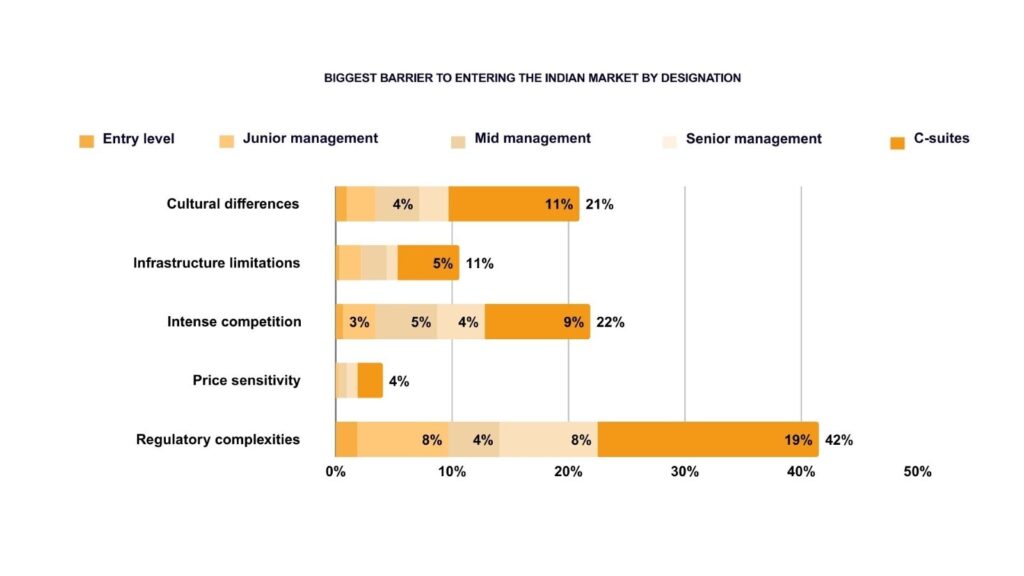

Interestingly, 42% of senior executives favor wholly owned subsidiaries for control, but 50% of junior managers point to regulatory complexity as a big barrier. That’s a strong case for bringing in expert help.

Offshoring to India is no longer a cost arbitrage play—it’s a strategic move. The rewards are huge, but only for those who plan, localize, and adapt. The model you choose will define your pace, risk, and control—so pick wisely.

If you’re serious about setting up a GCC, delivery center, or offshore tech hub in India, check out our whitepaper for detailed case studies, compliance maps, and execution frameworks.

We co-create with our customers at the center, combining deep domain expertise with innovative technology and talent solutions to accelerate growth. Our passion for excellence drives us to transform businesses, unlocking new opportunities and delivering lasting impact.

Subscribe to our newsletter to get our newest articles instantly!

Smart Leaders Are Rethinking Outsourcing. Are You? As global businesses face margin pressure and tech talent gaps, outsourcing is evolving from a cost play to a growth strategy. We're inviting senior leaders to share their perspectives in a short survey that explores how companies are scaling faster and operating leaner through smarter outsourcing. Take the short survey now and lead the next wave of global delivery excellence.