Close

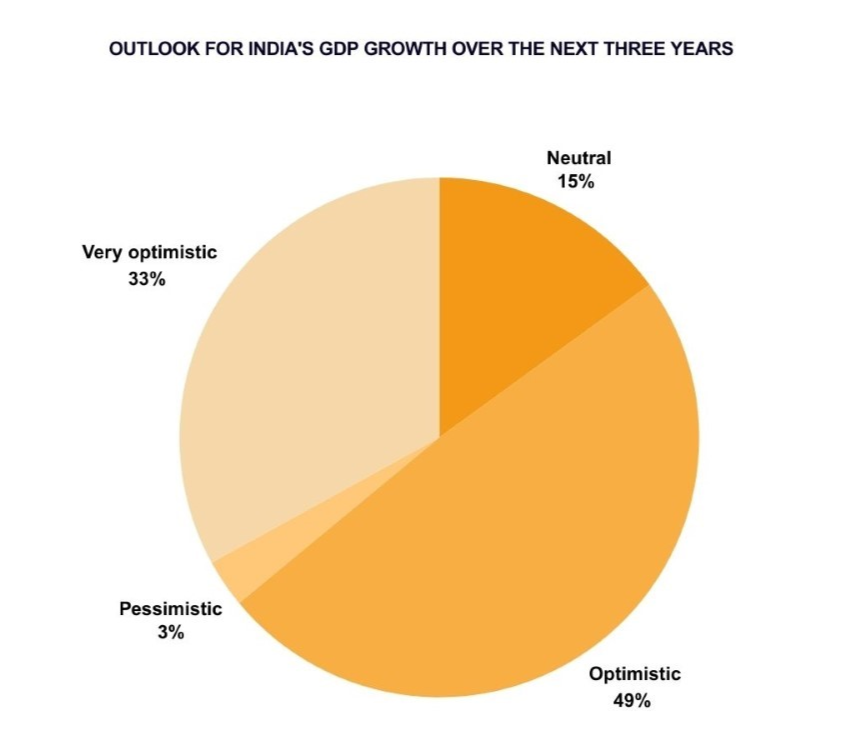

Speculation is over, India’s economic momentum is already reshaping global markets. With GDP expected to touch USD 5 trillion by 2027 and a median age of just 28.4, the country isn’t just growing—it’s surging. For businesses looking to offshore to India, understanding the legal requirements for starting a business in India is not optional—it’s foundational. It’s also home to the third-largest startup ecosystem in the world, and its digital backbone is unmatched, processing over 12 billion UPI transactions every month.

Global giants are taking notice. Apple, Foxconn, Tesla, Google—the logos are familiar, and so is the signal: India matters. But while the scale is attractive, the path isn’t exactly frictionless.

Offshoring success is anchored in execution—legal clarity, regulatory alignment, and local compliance rigor. This guide lays out the legal fundamentals to launch and scale an offshore operation in India, the smart way.

This isn’t a line item for the legal team—choosing the right entity shape is a strategic move. It sets the tone for control, tax, profit repatriation, and regulatory exposure.

| Legal Structure | FDI Access | Best Fit |

| Private Ltd (WOS) | 100% automatic in most sectors | Full control, long horizon |

| Joint Venture (JV) | Sector-dependent | Where local alignment or regulatory nuance is key |

| LLP | 100% in non-restricted sectors | Leaner setups—consulting, services |

| Branch/Liaison Office | RBI approval needed | Early-stage testing, non-commercial ops |

SRKay data shows over 42% of C-suites go with wholly-owned subsidiaries for full control.

India’s moved up sharply in ease-of-doing-business rankings—jumping from 142 to 63 between 2014 and 2020, but offshoring often adds another layer—cross-border financial structuring, intercompany agreements, and data handling protocols.

| Step | Who’s In Charge | Usual Timeline |

| Reserve Company Name | MCA | 3–5 working days |

| Director IDs & Digital Signatures | MCA | 1–2 days |

| Company Incorporation (SPICe+) | MCA | 7–10 days |

| PAN, TAN, GST registration | CBDT/GSTN | 5–7 days |

| Import-Export Code (if needed) | DGFT | 3–5 days |

| State Licenses | Local Authorities | 10–15 days |

India’s FDI regime may look liberal on the surface, but specifics matter. What’s fully open in one area might be gated in another. Offshoring into critical or sensitive sectors requires understanding both approval routes and local regulations.

| Sector | FDI Cap | Entry Route | Notes |

| IT/SaaS | 100% | Automatic | Must meet data localization norms (MeitY) |

| Greenfield Pharma | 100% | Automatic | CDSCO nod required |

| Brownfield Pharma | 74% | Auto up to 74%, beyond that needs approval | FIPB oversight kicks in |

| Multi-brand Retail | 51% | Government route | $100M floor, local sourcing rules |

| Defence | 74% | Auto up to 74% | MoD clearance mandatory |

You can get your offshore model launched—but if you miss compliance, you’re flying blind. Indian compliance is layered, periodic, and often state-specific.

What Needs Regular Attention:

According to recent industry surveys, statutory compliance remains a significant challenge for many foreign firms operating in India. While a majority report progress in adapting to local regulations, only a small proportion feel “very confident” about their ongoing compliance readiness.

India’s new labour codes aim to replace decades of outdated regulation—44 laws consolidated into four thematic codes. Over 25 states have floated drafts, with full rollout expected in FY 2025.

Meanwhile, two other frameworks are fast reshaping corporate obligations:

Your choice of state can tilt everything—from compliance headaches to cost efficiency to the incentives on offer.

| State | Capital Subsidy | Focus Sectors | EoDB Rank |

| Tamil Nadu | 20–25% | Auto, Textiles | #2 |

| Karnataka | 15% | IT, R&D, Electronics | #3 |

| Gujarat | 25% | Chemicals, Engineering | #5 |

| Maharashtra | 20% | Pharma, Banking, Logistics | #4 |

Foxconn’s semiconductor plant in Tamil Nadu didn’t land there by chance—it was the state’s fast land clearance and digital infrastructure that sealed the deal.

Offshoring is a long game. The winners don’t just set up—they embed, integrate, and evolve. Legal, ESG, and data frameworks aren’t red tape—they’re the scaffolding for scale.

What high-performing offshore teams get right:

Laws evolve. So do investors, regulators, and markets. What worked three years ago might not fly tomorrow.

To stay ahead:

Navigating the legal requirements for starting a business in India isn’t just about compliance—it’s about getting it right from the start. That’s where consulting firms add value and help you align regulatory, operational, and strategic priorities for sustainable growth.

Download the Full Legal Market Entry Whitepaper

We co-create with our customers at the center, combining deep domain expertise with innovative technology and talent solutions to accelerate growth. Our passion for excellence drives us to transform businesses, unlocking new opportunities and delivering lasting impact.

Subscribe to our newsletter to get our newest articles instantly!

Smart Leaders Are Rethinking Outsourcing. Are You? As global businesses face margin pressure and tech talent gaps, outsourcing is evolving from a cost play to a growth strategy. We're inviting senior leaders to share their perspectives in a short survey that explores how companies are scaling faster and operating leaner through smarter outsourcing. Take the short survey now and lead the next wave of global delivery excellence.